Scenario A (most likely): tech spending down 2.7% in 2020 4.5% growth in 2021 (tech outsourcing suffers in downturn, software spending leads recovery) Germany: tech spending to decline by 5.2% in 2020 4.1% growth in 2021 (computer equipment -8%, tech consulting services -6%, software -5% in 2020)įorrester Adjusts Australian Tech Spend Forecast Downwards.France: tech spending to decline by 6.6% in 2020 6.3% growth in 2021 (tech consulting services -7%, tech outsourcing -7%, software & comms equipment -6% in 2020).UK: tech spending to decline by 9.3% in 2020 and 1.1% in 2021 (computer equipment -9%, comms equipment -11%, software -10% in 2020) The weakness in software investment is likely to be a precursor to further declinesįorrester Forecasts EU Tech Spending Could Decline By Up to 9% In 2020 Due To The Coronavirus Pandemic.The pickup in computer and communications equipment investment will most likely be reversed.Here's a summary:įorecasting In Uncertainty: Q2 2020 US GDP Report Reveals Negative Surprises For US Economy But Positives For US Tech MarketĪ big drop in real GDP in Q2 2020 sets the stage for what will look like an impressive rebound in Q3 2020, but the economic recession will not be over and may well get worse

#It budget planning series#

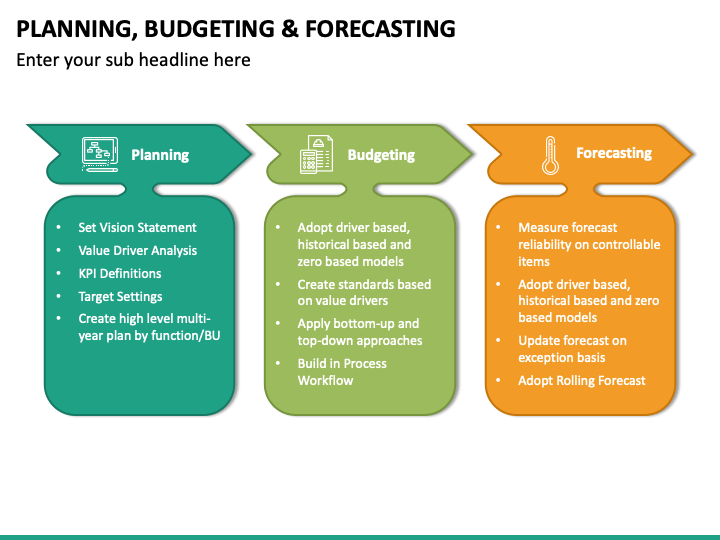

It's also likely, of course, that some entire businesses will fail to survive the economic disruption caused by the pandemic.Īnalyst firm Forrester has issued a series of tech spending forecasts for different parts of the world since the coronavirus pandemic took off. However, as Gartner notes: "In the absence of a vaccine or cure for COVID-19, any rebound in business activity could easily be followed by another round of response, recover, renew, so the imperative is to absorb lessons learned quickly and build sustainable changes into business and operating models."ĭepending on the type and location of the business, the outcome of this planning activity for business units, products or services may be positive (rescale, reinvent), neutral (return) or negative (reduce, retire). But, he added, "The smooth 'swoop' recovery of top line IT spending masks a very turbulent recovery across some countries, industries and markets."Īs lockdowns ease around the world, many businesses will currently be in the 'recover' phase - restarting their activities, rebudgeting, and planning to 'restore a scalable state'. This pause and restart will push growth out of 2020 and into 2021," said John-David Lovelock, distinguished research vice president at Gartner.

"With the easing of lockdown restrictions, many enterprises will soon return to a higher level of revenue certainty, allowing some cash flow restrictions to ease and CIOs to resume spending on IT again. Overall, the analyst firm seems cautiously optimistic about IT spending in 2020/21, expecting recovery to outpace that of the overall economy. Cloud-based conferencing will see a 46.7% increase in 2020, for example, while Gartner forecasts 13.4% growth in IaaS (infrastructure as a service) to $50.4 billion in 2020 and 27.6% growth to $64.3 billion in 2021. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs.Gartner expects that, as revenues decline and IT projects back up, CIOs "will gravitate toward spending on subscription products and cloud services to lower upfront costs".

These ads are based on your specific account relationships with us. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

#It budget planning Offline#

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. We strive to provide you with information about products and services you might find interesting and useful.

0 kommentar(er)

0 kommentar(er)